Our client encountered challenges in managing complex financial data during the migration process, which included investment tracking and regulatory reporting. The core transaction data was spread across various platforms and services, resulting in delays in obtaining insights and delivering data.

Additionally, they faced difficulties in balancing risk management and regulatory compliance in real-time. Moreover, there was a lack of robust data masking for critical information and other access controls increased vulnerability to data breaches and compliance violations.

Continue Reading

So, the client sought a team of experts to address these issues and modernize their data management practices.

Solution: Simplified financial data management with Databricks

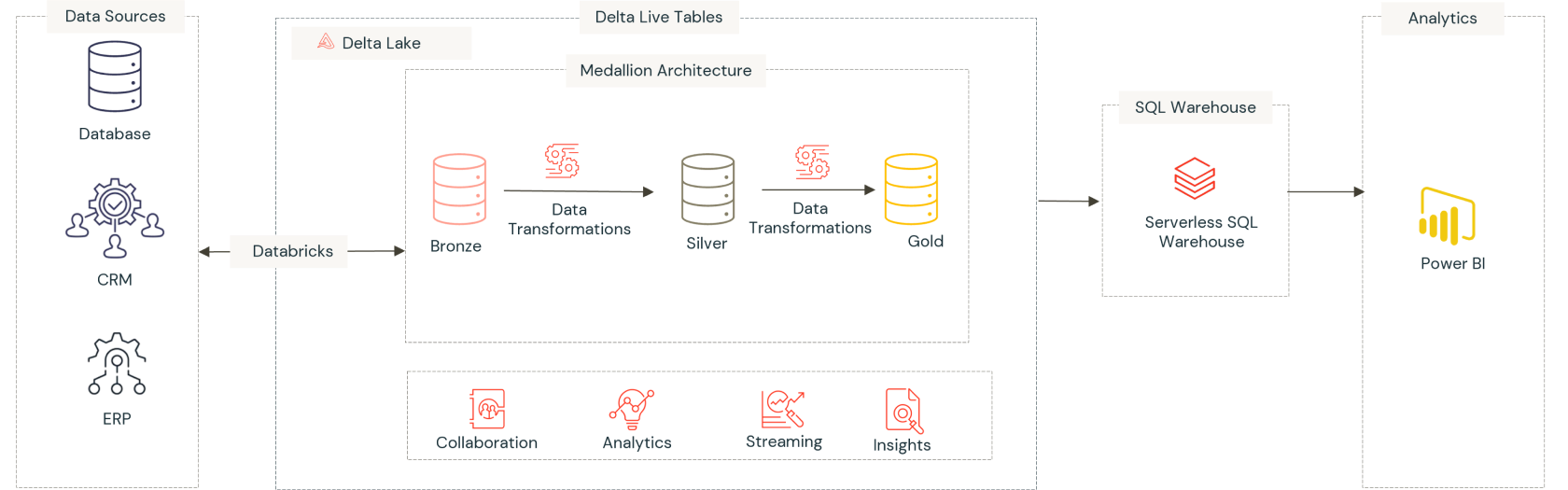

zeb experts devised a comprehensive solution for bidirectional data synchronization between Oracle financials and AWS Aurora PostgreSQL databases.

- Canonized Data Model: We designed a robust data model tailored for finance management, enabling accelerated ETL development and deployment of a Delta Lakehouse.

- Single Source of Truth: Leveraging Data Lakehouse and Databricks SQL Serverless, we created a prebuilt solution to consolidate data from various financial systems, forming a single source of truth.

- Data Masking and Security: We ensured the security of Personally Identifiable Information (PII) data by implementing data masking across critical information within Databricks Delta Lakehouse.

Benefits: 56% enhanced operational efficiency and 67% improved decision-making

- Improved operational efficiency by 56%, allowing for smoother processes and quicker insights.

- Reduced risks by 48%, helping the client navigate regulatory challenges and potential financial pitfalls.

- Achieved a 25% improvement in data security and compliance measures through Role-based access security, ensuring better protection for sensitive information.

- Gain comprehensive decision support, potentially improving decision accuracy by 67% with real-time analytics.

- Enhanced data privacy and compliance by 47%, reducing the risk of data breaches and ensuring compliance with regulations.

Ready to transform your financial analytics?

Whether you’re struggling with scattered financial data or facing challenges in real-time risk management, we have the expertise to address your needs effectively. Our team is dedicated to understanding your specific requirements and providing tailored solutions that enhance operational efficiency and compliance.

Partner with us to leverage the power of Databricks and unlock insights for better decision-making and risk mitigation.