zeb Achieves ServiceNow Premier Partner Status

zeb Wins AWS Rising Star Partner of the Year – Consulting Award

Our client faced critical challenges in optimizing its data infrastructure and application performance, which were impacting the overall user experience and operational efficiency. Key challenges included,

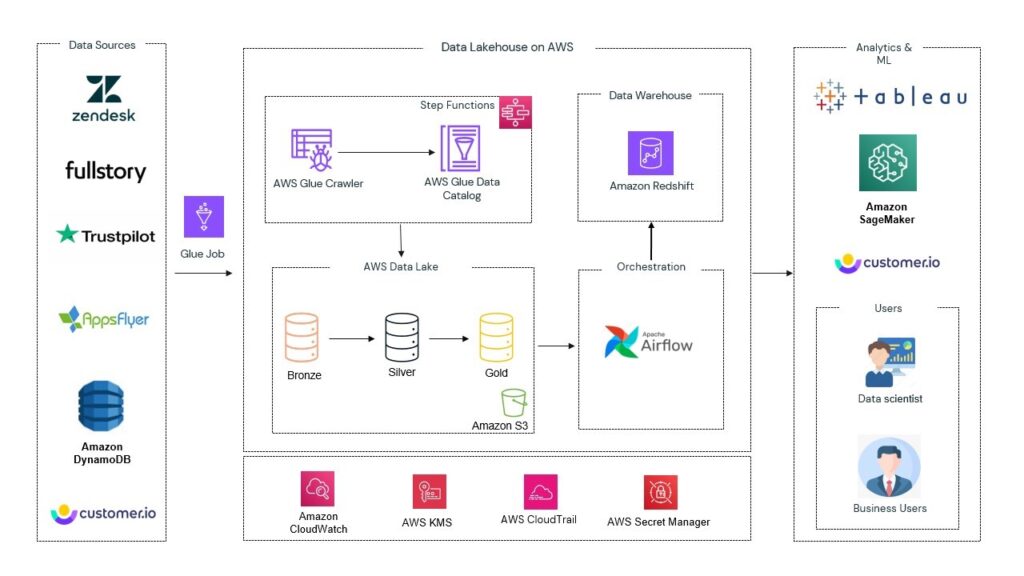

zeb provided a comprehensive solution to address the client’s challenges, focusing on modernizing their data infrastructure, improving real-time processing, and leveraging AI to gain business insights. The key components of the solution included,

zeb’s comprehensive data and application architecture solutions, combined with the AI-driven POC, delivered significant benefits to Credit Genie.

Credit Genie transformed its data infrastructure and application architecture, addressing critical challenges in data processing, security, and scalability. Through AI-driven insights from the POC, Credit Genie now has the tools to better understand its customers and identify new growth opportunities. This positions them for long-term success in the competitive fintech market.

Contact us today