Private equity firms today face a complex landscape marked by rising competition, economic and geopolitical uncertainty, regulatory pressures, and increasing demands for transparency from investors and the wider public alike. Sourcing high-quality deals, operating thorough due diligence, and driving operational improvements across diverse portfolio companies have become more challenging than ever. At the same time, the need to optimize returns, manage risks, and deliver measurable value creation has never been greater.

To overcome these hurdles, leading private equity firms are turning to data and analytics as a strategic differentiator. By integrating and analyzing data from across their portfolios, deal pipelines, and market sources, firms can gain actionable insights that drive smarter investment decisions, enhance operational efficiency, and identify new growth opportunities. Data-driven approaches empower PE firms to benchmark performance, automate reporting, forecast trends, and respond quickly to market shifts—ultimately improving portfolio company outcomes, strengthening investor confidence, and maximizing exit valuations

Databricks, the Lakehouse, and the Private Equity Lakehouse Accelerator are well-positioned to meet these demands.

The Private Equity Lakehouse Accelerator on Databricks is designed to address the core challenges PE firms face—data fragmentation, lack of standardization, and limited visibility—by unifying portfolio, investor, deal, and market data into a single, governed platform. This enables firms to drive operational excellence, discover new growth opportunities, and deliver superior returns across their investments.

Continue Reading

How Databricks transforms private equity operations

- Standardizing and Unifying Data Across the Portfolio

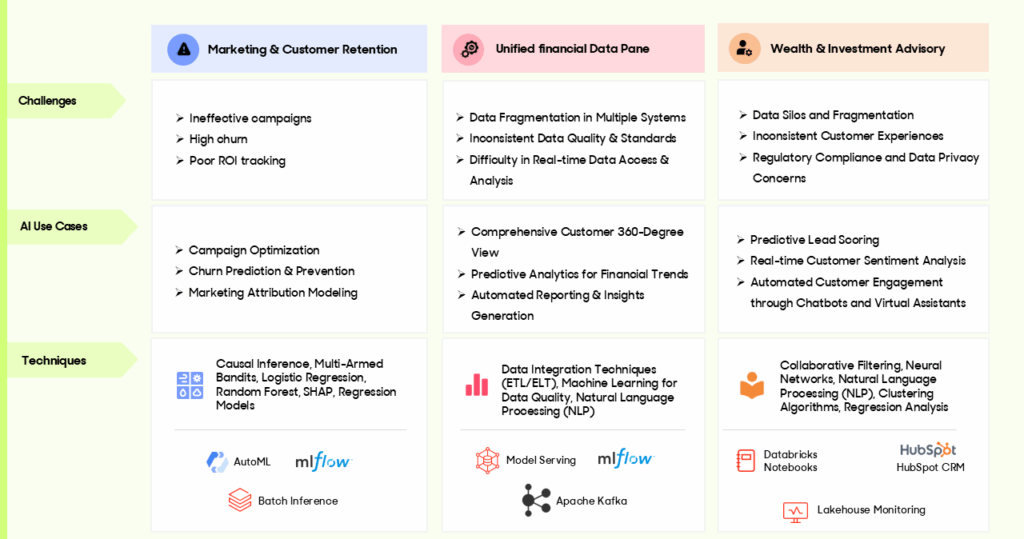

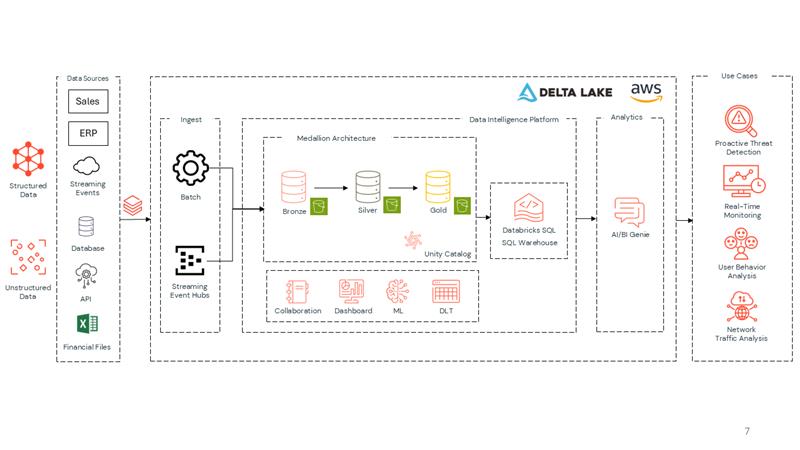

- Challenge: When acquiring new companies, PE firms inherit disparate systems and new systems that are not already part of the existing ecosystem (ERP, CRM, Excel, etc.), making it difficult to get a clear, real-time and most importantly holistic view of performance, cashflow and operational intelligence.

- Solution: By consolidating data into a unified lakehouse architecture and forming that single source of truth for all things Finance and PE, Databricks enables these firms to standardize financial, operational, and customer data from all portfolio companies. This streamlines reporting, enforces consistent governance, and allows for efficient cross-portfolio analytics.

- Accelerating Value Creation with Real-Time Insights

- Portfolio Performance Dashboards: Executives can track EBITDA, IRR, and operational KPIs across all investments in real time, enabling faster identification of underperformers and high-growth opportunities.

- Investor Reporting: Automated, consolidated LP/GP reports reduce manual effort and improve transparency, strengthening investor relations.

- Deal Sourcing & M&A: By integrating market, competitor, and alternative data, PE firms can use predictive analytics to identify attractive acquisition targets and optimize deal flow.

- Driving Operational Efficiency and Cost Savings

- Operational Optimization: Databricks’ AI models help portfolio companies forecast demand, optimize pricing, and streamline supply chains, directly impacting margins and growth.

- Cost Reduction: Consolidating fragmented data platforms onto Databricks reduces IT infrastructure, licensing, and maintenance costs, freeing up resources for value-adding activities.

- Enabling Advanced AI/ML for Competitive Advantage

- Predictive Valuation Models: Use Databricks’ ML and Mosaic AI to forecast company valuations and assess risk, supporting smarter investment decisions.

- Fraud Detection & Risk Management: Real-time anomaly detection protects against financial fraud and compliance breaches.

- Document Intelligence: GenAI tools (like Llama models) automate due diligence by summarizing contracts and regulatory filings, speeding up deal cycles and reducing legal costs.

- Ensuring Compliance and Data Governance

- Unity Catalog: Centralized governance ensures data lineage, access controls, and audit trails across all portfolio data. This is critical for meeting GDPR, CCPA, and SEC requirements, and for enabling secure data sharing with investors and regulators.

- Automated Regulatory Reporting: Databricks automates the generation of audit-ready reports, reducing compliance risk and manual workload.

Summary

- By implementing the Private Equity Lakehouse Accelerator on Databricks, PE firms can:

- Achieve a single source of truth across all portfolio companies.

- Empower business users with self-service analytics and AI-driven insights.

- Reduce costs, streamline operations, and accelerate value creation.

- Ensure robust governance and compliance at scale.

This positions private equity firms to not only maximize returns but also to operate with the agility and intelligence needed in today’s data-driven investment landscape.

Ready to accelerate your private equity performance with Databricks?

Contact zeb today to explore how the Private Equity Lakehouse Accelerator can help you gain real-time insights, streamline operations, and drive measurable value across your investments.

Let’s turn your data into a competitive edge.